There’s No Reason To Panic Over Today’s Lending Standards

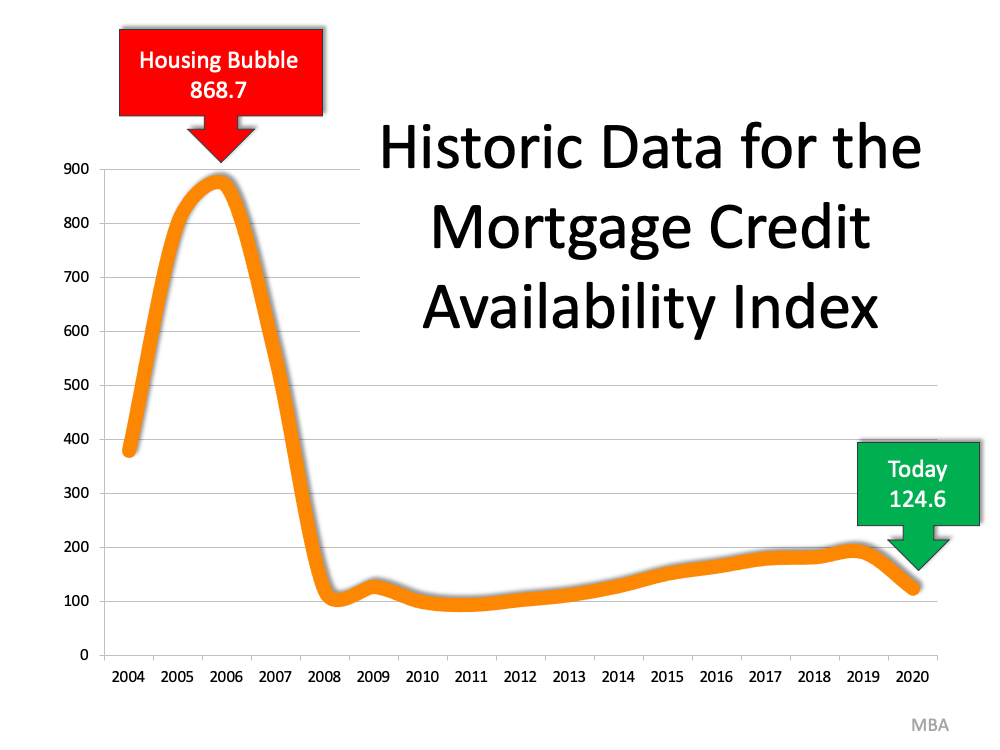

Recent articles about the availability of low down payment loans and down payment assistance programs are causing fear that we’re returning to the bad habits seen 15 years ago. In this article, we alleviate these concerns.