So now that I know my Credit Score, what does it mean?

When evaluating a borrower for a mortgage loan, we look at all three credit bureaus (Experian, Transunion and Equifax). We call it a “Tri-Merge” report. The underwriter will use your middle credit score when evaluating your file for approval. For example, if you have a 720 score with Experian, a 745 score with Transunion and a 700 score with Equifax, we would use the 720 score. This is also the score that we use to determine interest rate pricing (the higher the score, the cheaper the rate).

Look up your middle credit score in the chart below:

| Score Range | Credit Range |

|---|---|

| 760 to 850 | Excellent |

| 700 to 759 | Very Good |

| 660 to 699 | Good |

| 620 to 659 | Below Average |

| 580 to 619 | Poor |

| 300 to 579 | Very Poor |

There are very few options available to those with credit scores below 580, but some programs are out there.

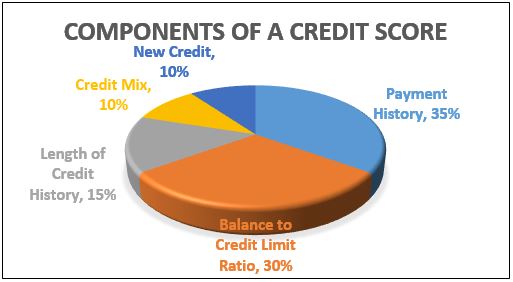

Components of a Credit Score

Your credit scores are calculated based on multiple factors. Here’s a great breakdown for you:

| Factor | Approx % of Score |

|---|---|

| Payment History | 35% |

| Balance to Credit Limit Ratio | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

Here are some common questions we are asked about credit reports:

| Question | Answer |

|---|---|

| What is a soft credit inquiry? | When an existing creditor or marketing company runs your credit. Does not affect your credit scores. |

| What is a self-made credit inquiry? | When an individual requests their own credit report. Does not affect your credit scores. |

| What is a hard inquiry? | When creditors or lenders request your credit report to determine whether to extend new credit. This does negatively affect your credit scores. |

| How long do negative activities stay on your credit report? | Chapter 7 Bankruptcy – 10 years Chapter 13 Bankruptcy – 7 years Foreclosures – 7 to 10 years Charge offs and collection accounts – 7 years Late payments – 7 years Trade account closed by creditor – 7 years Tax Liens – 7 years from date paid in full |

| How long do credit inquiries stay on your credit report? | Up to 2 years |

| What are common types of derogatory credit or conditions that negatively affect my credit? | Multiple late accounts Carrying high balances on credit cards Delinquent housing payments Adverse public records like Judgments, Tax Liens, Bankruptcy Questionable credit practices during the past 24 months |