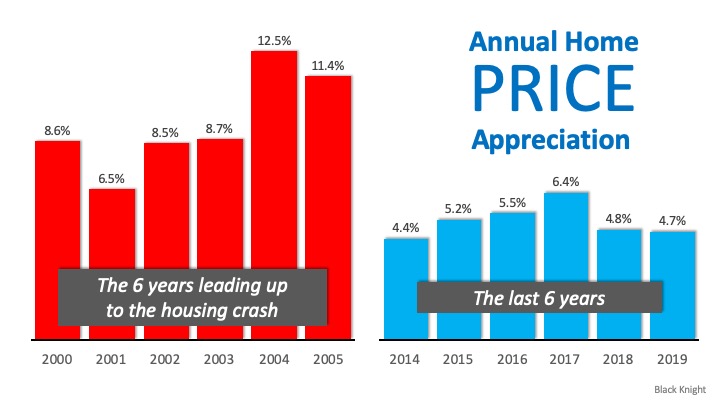

Housing Market Positioned to Bring Back the Economy

Every time a home is sold it has a tremendous financial impact on local economies. As the real estate market continues its recovery, it will act as a strong tailwind to the overall national economy.